News

Hlib Research Makes Overweight Call On Renewable Energy Sector

KUALA LUMPUR, July 12 (Bernama) -- Hong Leong Investment Bank (HLIB) Research has given an overweight recommendation on the renewable energy (RE) sector given its strong potential growth from an apolitical multi-year energy transition theme.

The research house, in initiating coverage on the sector, said key catalysts include the Corporate Green Power Programme awards, Budget 2024 and future roadmaps/implementation plans.

“We believe the growth of environmental, social, and corporate governance (ESG) investing could drive a rerating of RE stocks with the tepid supply in the Malaysian market,” it said in a note today.

HLIB Research said since the turn of the year, the government has rolled out a few announcements indicating greater focus on RE policies going forward.

It said the biggest sector uplift perhaps came from Economy Minister Rafizi Ramli’s announcement that in addition to RE targets outlined by the Malaysia Renewable Energy Roadmap (MyReR), the government is looking at an RE capacity share target of 70 per cent by 2050.

“By today’s estimates, investments of RM637 billion are required to achieve this, which would include spending on grid infrastructure, new RE generation capacities, energy storage integration and grid operating costs,” it said.

According to Rafizi, the government is set to roll out its Energy Transition Roadmap in phases, identifying key impact initiatives and implementation plans for the next two decades .

“These plans are sector positive given that it crystallises prospects beyond the MyRER,” said HLIB.

MyRER was commissioned in 2021 to support further decarbonisation of the electricity sector in Malaysia through the 2035 milestone.

This is expected to drive a reduction in greenhouse gas (GHG) emissions in the power sector in meeting its Nationally Determined Contributions 2030 target of 45 per cent reduction in GHG emission intensity per unit of gross domestic product in 2030 compared to the 2005 level, and a further reduction of 60 per cent in 2035.

HLIB said Malaysia’s trump card in its decarbonisation journey is high year-round solar irradiance due to its location near the equator.

The country is planning to build installed solar capacity of 7,280 megawatts (MW) by 2035, an increase of 5,746 MW versus 2020 installed capacity, corresponding to a compound annual growth rate of 10.9 per cent.

HLIB has initiated ratings on two stocks that were the only Main Market listed solar engineering, procurement, construction and commissioning players, namely Samaiden Group and Solarvest Holdings.

It has placed a buy call on Samaiden with a target price (TP) of RM1.43 per share and a hold call on Solarvest with a TP of RM1.20 per share.

At 11.57 am, Samaiden was up 20 sen at RM1.16 while Solarvest fell one sen to RM1.23 compared to yesterday’s close.

-- BERNAMA

Other News

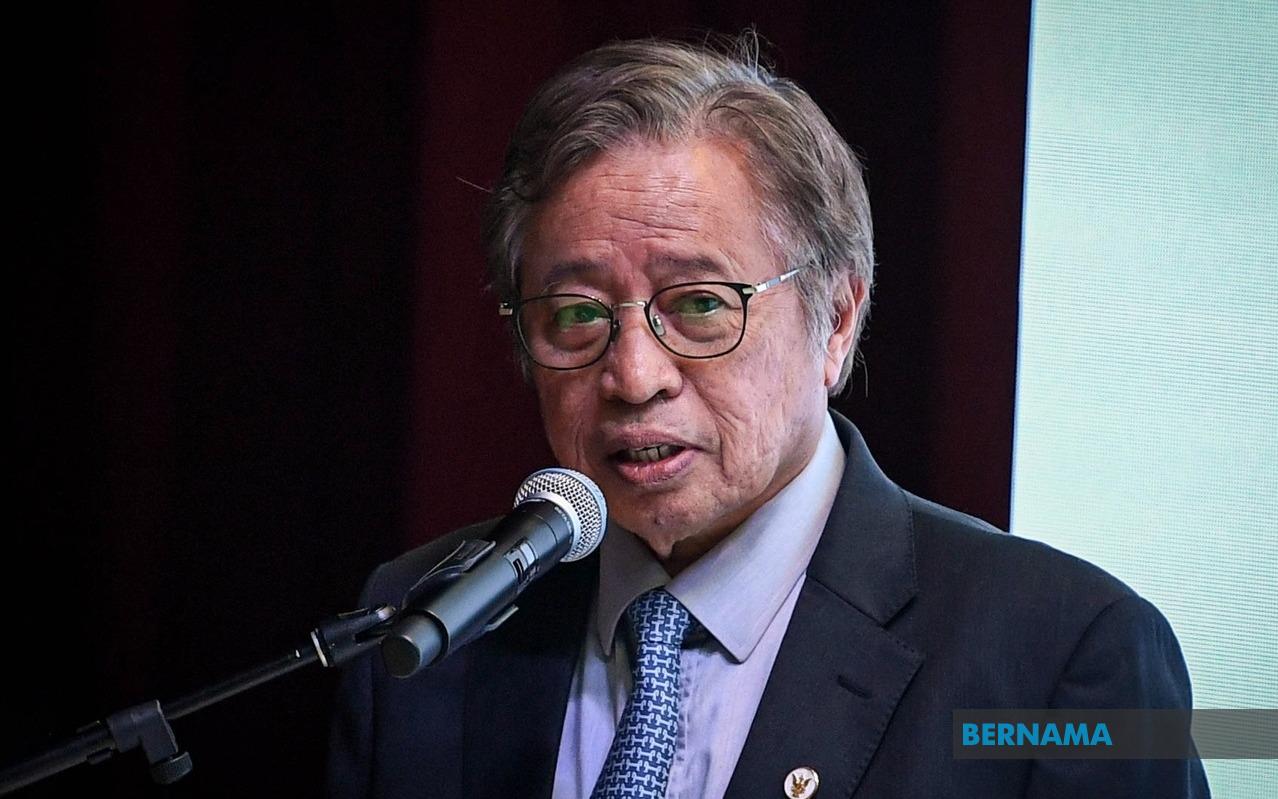

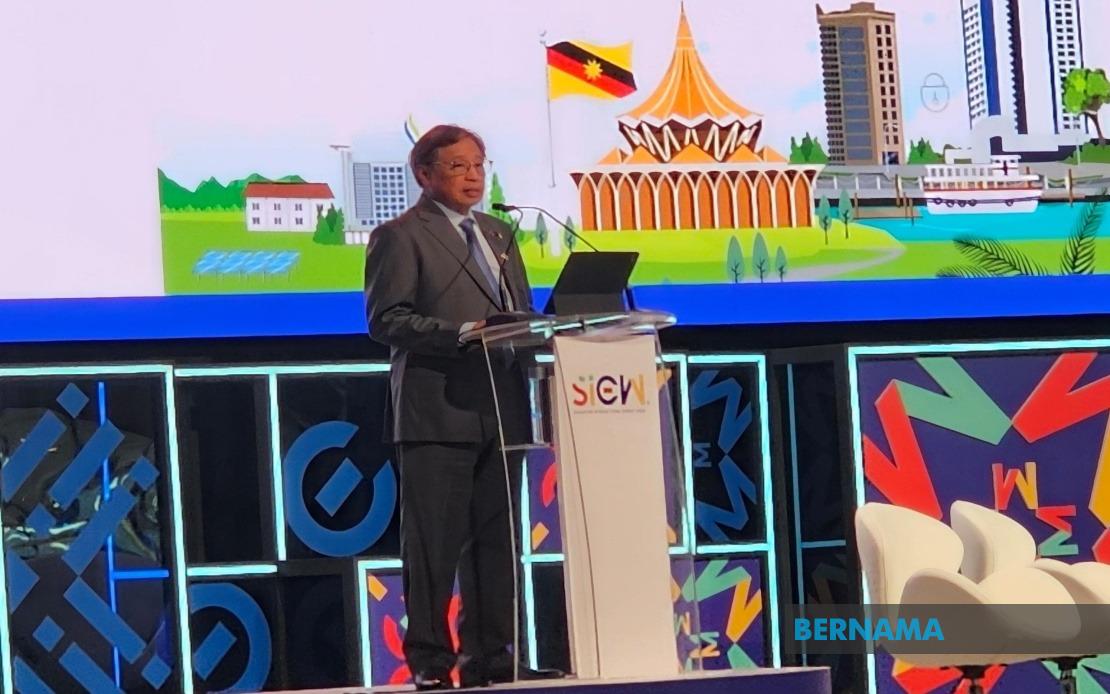

Sarawak Lepasi Sasaran Kapasiti Gabungan Tenaga Boleh Baharu Tahun Ini - Abang Johari

Oleh Nur Ashikin Abdul Aziz

SINGAPURA, 21 Okt (Bernama) -- Sarawak mencapai 62 peratus sasaran campuran kapasiti tenaga boleh baharu (TBB) tahun ini, melepasi sasaran 60 peratus yang digariskan dalam Strategi Pembangunan Pasca COVID-19 (PCDS) 2030.

Sarawak Pacu Pertumbuhan Tenaga Boleh Diperbaharui Untuk Manfaat ASEAN - Premier

SINGAPURA, 21 Okt (Bernama) -- Sarawak komited menyokong peralihan tenaga boleh diperbaharui di Asia Tenggara dengan memanfaatkan potensinya sebagai "Bateri ASEAN," yang akan membekalkan tenaga bersih menerusi sambungan Grid Kuasa Borneo dan ASEAN.

Belanjawan 2025 Percepat Peralihan Kepada Tenaga Bersih - Solarvest

KUALA LUMPUR, 19 Okt (Bernama) -- Belanjawan 2025 merupakan satu langkah ke arah mempercepat peralihan kepada tenaga bersih di Malaysia, kata Solarvest Holdings Bhd.

© 2025 BERNAMA. All Rights Reserved.

Disclaimer | Privacy Policy | Security Policy This material may not be published, broadcast,

rewritten or redistributed in any form except with the prior written permission of BERNAMA.

Contact us :

General [ +603-2693 9933, helpdesk@bernama.com ]

Product/Service Enquiries [ +603-2050 4466, digitalsales@bernama.com ]