News

Agrobank: No additional profit charges during automatic moratorium period

KUALA LUMPUR, May 2 -- Agrobank announced today that it will not impose any additional profit charges on financing for all eligible individual and small- and medium-sized enterprise (SME) customers during the six-month automatic moratorium period.

This followed Bank Negara Malaysia’s (BNM) announcement that fixed-rate Islamic financing may come with additional profit charges after the six-month moratorium effective from April 1 to September 30 this year.

"Agrobank is committed to relieving our customers’ distress during these trying times. Therefore, for our fixed-rate financing customers especially the micro financing customers, there would be no change in the current amount of outstanding and profits borne by our customers,” covering president and chief executive officer Khadijah Iskandar said in a statement.

The customers will pay the same monthly repayment amount from October 2020 onwards, but the financing tenure will be extended to another six months to accommodate the six-month grace period during the automatic moratorium, she said.

The bank hopes that the announcement will be able to provide them further relief from their financing obligations and help them weather the other challenges they may be facing.

“The COVID-19 pandemic is an unfortunate situation which has affected businesses including those in agriculture industry, particularly small and micro businesses. This move will benefit many of our micro financing customers," she said.

Agrobank also stressed that the payment deferment is still automatic for its customers and no additional steps are required for the customers to be entitled to the moratorium facility.

However, for customers who do not wish to take up the moratorium, they can choose to do so by filling up a form on www.agrobank.com.my/no-mora and resume their scheduled payments based on the terms of their existing agreements.

For clients affected by COVID-19, Agrobank also provides coaching and counseling session for their business. Customers can contact mohdnazry@agrobank.com.my and hasanul.israq@agrobank.com.my to receive these services.

-- BERNAMA

Other News

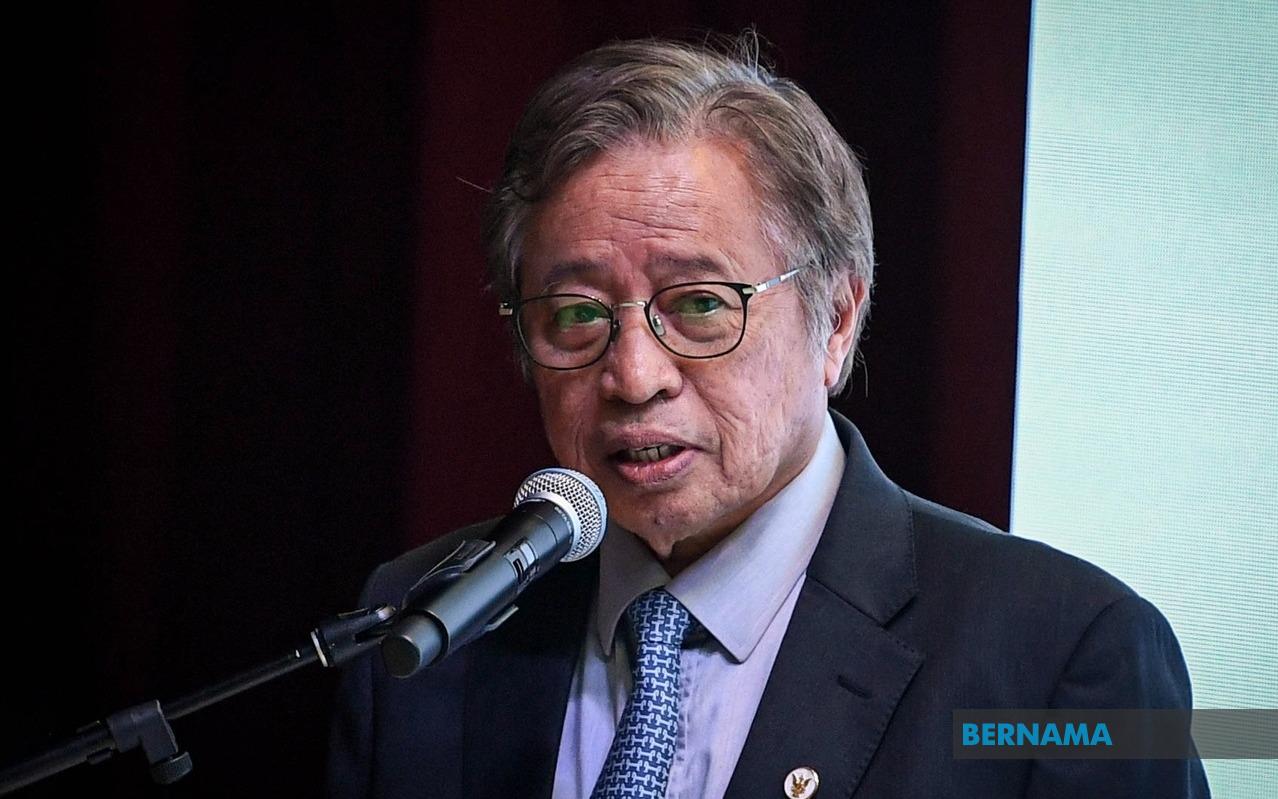

Sarawak Lepasi Sasaran Kapasiti Gabungan Tenaga Boleh Baharu Tahun Ini - Abang Johari

Oleh Nur Ashikin Abdul Aziz

SINGAPURA, 21 Okt (Bernama) -- Sarawak mencapai 62 peratus sasaran campuran kapasiti tenaga boleh baharu (TBB) tahun ini, melepasi sasaran 60 peratus yang digariskan dalam Strategi Pembangunan Pasca COVID-19 (PCDS) 2030.

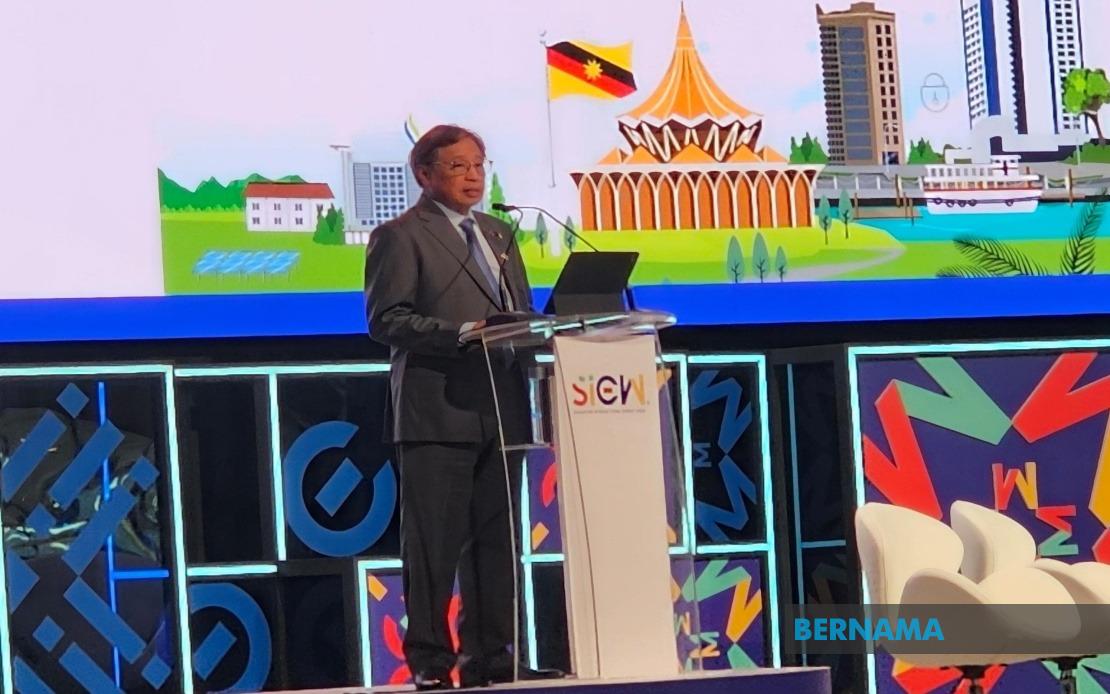

Sarawak Pacu Pertumbuhan Tenaga Boleh Diperbaharui Untuk Manfaat ASEAN - Premier

SINGAPURA, 21 Okt (Bernama) -- Sarawak komited menyokong peralihan tenaga boleh diperbaharui di Asia Tenggara dengan memanfaatkan potensinya sebagai "Bateri ASEAN," yang akan membekalkan tenaga bersih menerusi sambungan Grid Kuasa Borneo dan ASEAN.

Belanjawan 2025 Percepat Peralihan Kepada Tenaga Bersih - Solarvest

KUALA LUMPUR, 19 Okt (Bernama) -- Belanjawan 2025 merupakan satu langkah ke arah mempercepat peralihan kepada tenaga bersih di Malaysia, kata Solarvest Holdings Bhd.

© 2025 BERNAMA. All Rights Reserved.

Disclaimer | Privacy Policy | Security Policy This material may not be published, broadcast,

rewritten or redistributed in any form except with the prior written permission of BERNAMA.

Contact us :

General [ +603-2693 9933, helpdesk@bernama.com ]

Product/Service Enquiries [ +603-2050 4466, digitalsales@bernama.com ]