News

Hibiscus Petroleum to undertake fundraising, reports sharp drop in Q1 earnings

KUALA LUMPUR, Nov 21 -- Hibiscus Petroleum Bhd is expected to undertake fundraising activities over the next six months as it gears up to acquire more producing assets, especially in Southeast Asia.

The group currently has no debt and is in a position to gear up to a conservative level as the need arises, it said in a corporate and business update issued in conjunction with the release of its latest quarterly results.

“Based on our projected activities, we envisage that some borrowings may be required and we are currently considering various debt options that are on offer,” the company said.

Hibiscus Petroleum’s unrestricted cash balance stood at RM179.4 million as at Sept 30.

The group reported a sharp drop in net profit to RM16.23 million in the first quarter ended Sept 30, 2019, from RM100.0 million a year earlier, with revenue being more than halved to RM159.30 million from RM359.96 million previously.

Hibiscus Petroleum sold 44 per cent fewer barrels of oil under the North Sabah segment (at 334,613 barrels) and 48 per cent less crude under the Anasuria Hibiscus segment (at 272,345 barrels) at lower average realised prices per barrel compared to the corresponding quarter last year.

Production was affected by planned maintenance activities at its offshore platforms and the Anasuria floating production, storage and offloading vessel.

Under its 2021 Mission, the company targets to deliver a daily production of about 20,000 barrels per day of oil or oil equivalent.

In its business update, Hibiscus Petroleum said it expected high-quality acquisition opportunities would be emanating in Southeast Asia as the fields in the area matured and established players looked to review their portfolios.

On the back of its newly drilled wells in Malaysia and the United Kingdom, the group is targeting to deliver 3.3 to 3.5 million barrels of oil in financial year ending June 30, 2020, which is up to 16 per cent higher than the actual oil delivered in the previous financial year.

“We have clearly established our 2021 Mission and the group as a whole is actively working towards achieving it. By 2021, existing assets are expected to deliver 12,000 barrels of net oil per day. We will close the gap with an acquisition,” said managing director Dr Kenneth Pereira in a press statement.

He added that the group would be extremely selective and would only invest in assets that it believed would generate strong positive cashflow.

-- BERNAMA

Other News

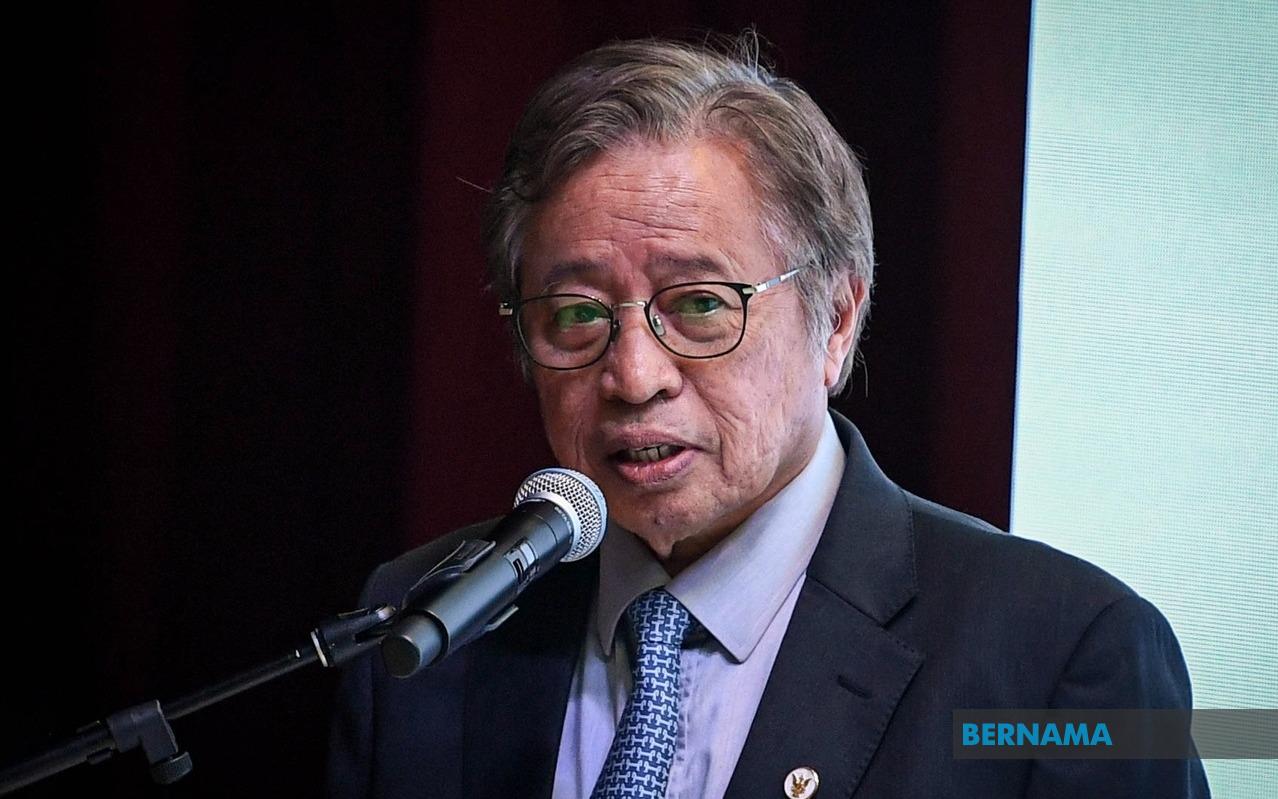

Sarawak Lepasi Sasaran Kapasiti Gabungan Tenaga Boleh Baharu Tahun Ini - Abang Johari

Oleh Nur Ashikin Abdul Aziz

SINGAPURA, 21 Okt (Bernama) -- Sarawak mencapai 62 peratus sasaran campuran kapasiti tenaga boleh baharu (TBB) tahun ini, melepasi sasaran 60 peratus yang digariskan dalam Strategi Pembangunan Pasca COVID-19 (PCDS) 2030.

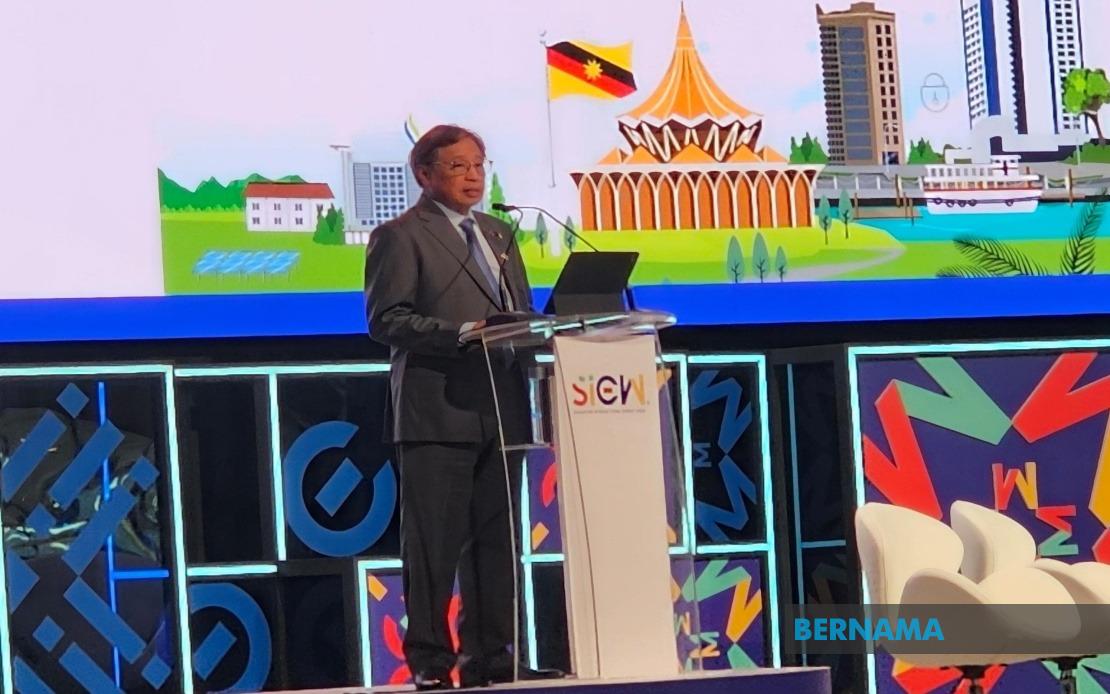

Sarawak Pacu Pertumbuhan Tenaga Boleh Diperbaharui Untuk Manfaat ASEAN - Premier

SINGAPURA, 21 Okt (Bernama) -- Sarawak komited menyokong peralihan tenaga boleh diperbaharui di Asia Tenggara dengan memanfaatkan potensinya sebagai "Bateri ASEAN," yang akan membekalkan tenaga bersih menerusi sambungan Grid Kuasa Borneo dan ASEAN.

Belanjawan 2025 Percepat Peralihan Kepada Tenaga Bersih - Solarvest

KUALA LUMPUR, 19 Okt (Bernama) -- Belanjawan 2025 merupakan satu langkah ke arah mempercepat peralihan kepada tenaga bersih di Malaysia, kata Solarvest Holdings Bhd.

© 2025 BERNAMA. All Rights Reserved.

Disclaimer | Privacy Policy | Security Policy This material may not be published, broadcast,

rewritten or redistributed in any form except with the prior written permission of BERNAMA.

Contact us :

General [ +603-2693 9933, helpdesk@bernama.com ]

Product/Service Enquiries [ +603-2050 4466, digitalsales@bernama.com ]