News

Nominal impact on India's import of Malaysian palm oil even if duty increases - IJM

PETALING JAYA, Aug 27 -- Malaysian refined palm oil export into India will only be impacted nominally even if the Indian government decided to hike the import duty on the commodity, IJM Plantations Bhd said.

Chief financial officer and executive director Puru Kumaran said Indian consumers would continue to buy the vegetable oil for the upcoming festive season and their daily intake; hence the demand would not shrink.

"It is only about timing. India will continue to buy the oil until September this year for Deepavali and their next purchase will come next year in January for Hari Raya Aidilfitri," he told reporters after the company's annual general meeting here today.

The demand would only reduce if India's oilseed production was high, but currently their crop was not doing well, he explained.

Currently, India imposes a 40 per cent import tax on crude palm oil (CPO) and 50 per cent on refined palm oil.

However, Malaysia, under an agreement with India, has an advantage of being imposed an import tax of only 45 per cent on refined palm oil and this helped increase palm oil imports by India between January and July 2019.

Meanwhile, chief executive officer Joseph Tek Choon Yee said IJM Plantations was not looking to buy new land but will reserve cash to weather the storm faced by the plantation industry.

"We are in a consolidation mode and we are monitoring our operation to improve its standard operating procedure to ensure high quality products.

"We hope fresh fruit bunches production will cross the one million-tonne mark for financial year 2020 from the 976,000 tonnes recorded for financial year 2019," he said, adding that the group was hopeful that CPO prices would hover between RM2,100 and RM2,200 per tonne this year.

Tek, however, noted that for the group, the “comfortable level” would be RM2,300 per tonne.

He also said that the palm oil industry had seen an improvement in the CPO prices but acknowledged challenges such as higher cost of production, increase in minimum wages and foreign exchange movements.

“Overall, we expect to achieve a low double-digit growth if the recovery from the El Nino effect took place,” he said.

The group was in the red during the financial year ended March 31, 2019, with a net loss of RM36.34 million versus a net profit of RM27.86 million while revenue declined to RM630.90 million from RM747.22 million previously due to the lower CPO and crude palm kernel oil prices.

Its Indonesian operations oversee 35,852 hectares of planted areas, while its Malaysian operations, centred in Sabah, have 24,781 hectares.

-- BERNAMA

Other News

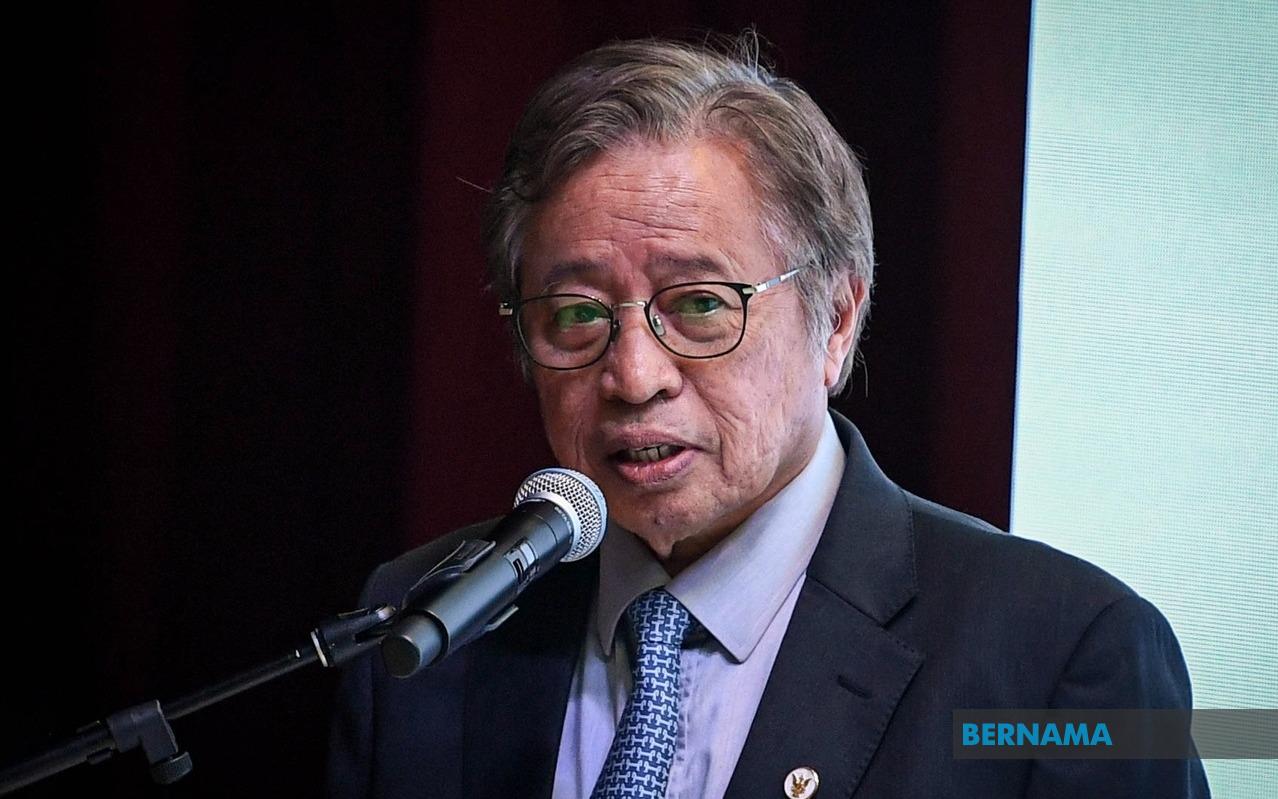

Sarawak Lepasi Sasaran Kapasiti Gabungan Tenaga Boleh Baharu Tahun Ini - Abang Johari

Oleh Nur Ashikin Abdul Aziz

SINGAPURA, 21 Okt (Bernama) -- Sarawak mencapai 62 peratus sasaran campuran kapasiti tenaga boleh baharu (TBB) tahun ini, melepasi sasaran 60 peratus yang digariskan dalam Strategi Pembangunan Pasca COVID-19 (PCDS) 2030.

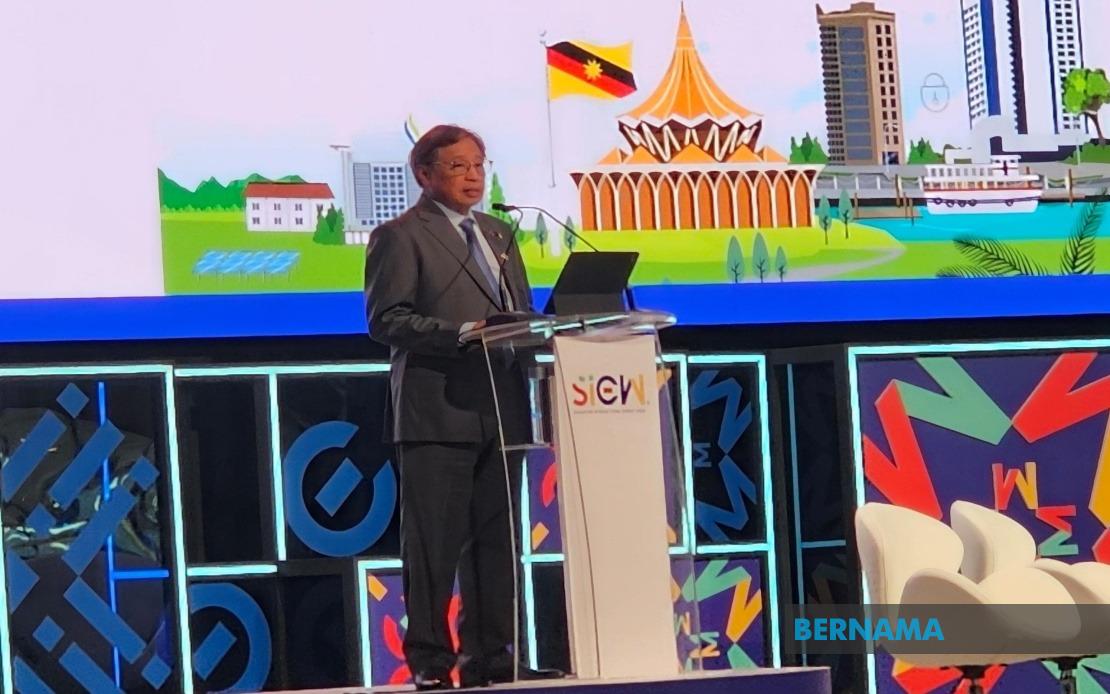

Sarawak Pacu Pertumbuhan Tenaga Boleh Diperbaharui Untuk Manfaat ASEAN - Premier

SINGAPURA, 21 Okt (Bernama) -- Sarawak komited menyokong peralihan tenaga boleh diperbaharui di Asia Tenggara dengan memanfaatkan potensinya sebagai "Bateri ASEAN," yang akan membekalkan tenaga bersih menerusi sambungan Grid Kuasa Borneo dan ASEAN.

Belanjawan 2025 Percepat Peralihan Kepada Tenaga Bersih - Solarvest

KUALA LUMPUR, 19 Okt (Bernama) -- Belanjawan 2025 merupakan satu langkah ke arah mempercepat peralihan kepada tenaga bersih di Malaysia, kata Solarvest Holdings Bhd.

© 2025 BERNAMA. All Rights Reserved.

Disclaimer | Privacy Policy | Security Policy This material may not be published, broadcast,

rewritten or redistributed in any form except with the prior written permission of BERNAMA.

Contact us :

General [ +603-2693 9933, helpdesk@bernama.com ]

Product/Service Enquiries [ +603-2050 4466, digitalsales@bernama.com ]