News

TNB’s phenomenal role as catalyst of national development

By Mohd Khairi Idham Amran

KUALA LUMPUR, April 24 (Bernama) -- Tenaga Nasional Bhd (TNB) has come a long way since its establishment in 1949 as the Central Electricity Board (CEB) to become the catalyst of national development.

TNB, which is celebrating its 70th anniversary in September this year, has undergone several major transformation, including rebranding as the National Electricity Board (LLN) in 1965, privatisation in 1990 and corporatisation in 1992.

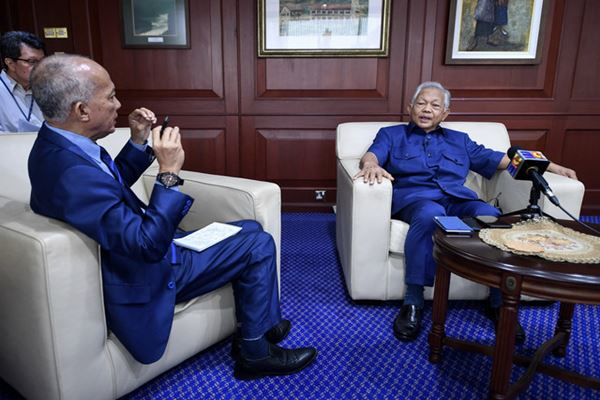

Chairman Tan Sri Leo Moggie said TNB has grown from strength to strength throughout the years, especially the period of demand boom for power supply since 1980s.

“TNB has grown matured for the last 70 years, has made major contributions to the development of the country and internally has also adjusted itself to be relevant at every stage of development in technology and every stage development of the country,” he told Bernama in an interview.

He said as with economic growth, the demand for electricity grew in tandem but TNB remained steadfast in delivering its duty as the sole electricity distributor in the country.

“We recorded the highest demand of electricity at 18,566 megawatt (MW) a few days ago as compared to 1978/1979 when the highest demand at that time was averaging 1,260 MW,” he said.

He said despite the surge in electricity demand, the electricity industry still has about 20 per cent of reserve margin to cover unexpected power generator plants breakdown.

Moggie said TNB has elevated the quality of electricity supply in the country as measured via the System Average Interruption Duration Index (SAIDI), a methodology used by the electricity industry worldwide to measure the length of time each consumer experiences power disruption in a year.

“TNB’s SAIDI record now 48 minutes and we are proud of it. We are better than the UK,” he said.

In comparison, SAIDI in England was 55 minutes last year, France (60 minutes), Ireland (90 minutes) and Australia (125 minutes,) while neighbouring country, Thailand has a SAIDI of 60 minutes.

He said another benchmark is Transmission System Minutes which measures the minutes of interruption caused by transmission per year whereby the company recorded less than a minute for 2018, a record that is comparable to developed nations.

“What it reflects is our transmission network is now actually quite efficient,” he said.

On people’s perception that TNB is monopolising the power industry, Moggie said such misconception derived from TNB’s role as the sole distributor of electricity in the country.

“In most countries, the main transmission network always seems to be a natural monopoly, which is managed usually by the regulated government agency,” he said.

However, he said the power generation industry in the country is open for participation to others known as the independent power producer (IPP) which was introduced in the early 1990s.

“TNB generation capacity on its own amounted to only about 49 per cent, while 51 per cent is actually generated by IPPs and then sold to TNB as single buyer on a long-term power purchase agreement (PPA),” he said.

He said the PPA is a long-term deal based on two components -- capacity charge and energy charge.

“Capacity charge is meant to allow the recouping of the capital investment on building a power plant, while energy charge is based on the fuel (gas or coal) price that is utilised to generate power, depending on the movement of the fuel price internationally,” he said.

He said the participation of the IPPs in the industry has helped to grow the industry and made it more competitive.

Moggie said other countries had introduced a more open system called merchant market where the contract period is shorter and interested companies can build power plant and sell it to the utilities that transmit and sell to the consumers in a very competitive environment.

“The risk there is new investors may not be prepared to put investment on new generating capacity without an assurance from the market and subsequently they go back to use the PPA,” he said.

He said the presence of the PPA gives potential investors the confidence in building new capacity because of assurance in return on investment.

Moggie also argued on the idea of completely liberalising the electricity supply, citing such move may not immediately leads to reduction in electricity prices as evidenced in the UK and other European countries.

“When the UK and other European countries started liberalising electricity supply, there was a slight increase in consumer bill.

“So, complete liberalisation may not immediately lead to reduction in price but there is a risk that it might increase,” he said.

He said another issue that would arise from completely liberalising the electricity supply would be on managing cross subsidy provided to the industry.

Without a proper way of managing the cross subsidy, it could be misused to benefit only a portion of the population, he added.

Going forward, he said TNB is preparing itself in anticipation of technology and market change.

“At TNB, we are already preparing ourselves in the last two years to ensure that our structure is ready when this change is going to happen. We called this programme ‘Reimagining TNB’,” he said.

He said the company has introduced smart metre that can be read remotely and allowed consumers to manage their consumption.

Moggie said TNB is also engaging the smart grid network to facilitate the increase injection of green renewable energy into the network.

Apart from that, he said TNB has also set up the retail division to manage consumers’ expectations.

“They (retail division) have to be very conscious of consumers’ expectations and their (consumers) expectations are very high.

“That is why we think at TNB level, we are as prepared as we should be and our experience in adapting to the expectations of the consumer market over the years will give us the confidence,” he said.

He also anticipates that the energy demand would grow at a slower pace in the coming years as the country’s economy is maturing and focusing more on the services sector compared to the manufacturing sector.

“Our projection is that demand will still increase but the rate of increase will not be as fast as it used to be. Before this, it used to be at four to five per cent but now it is less than two per cent,” he said.

He added that another factor contributing to the slower pace of demand growth would be consumers adopting to smart systems that stressed on energy efficiency.

To date, TNB transmission lines stretched over 6,300 kilometres, while its customer-base has reached 9.6 million, including in Sabah where it owns 83 per cent of Sabah Electricity Sdn Bhd.

-- BERNAMA

Other News

Sarawak Lepasi Sasaran Kapasiti Gabungan Tenaga Boleh Baharu Tahun Ini - Abang Johari

Oleh Nur Ashikin Abdul Aziz

SINGAPURA, 21 Okt (Bernama) -- Sarawak mencapai 62 peratus sasaran campuran kapasiti tenaga boleh baharu (TBB) tahun ini, melepasi sasaran 60 peratus yang digariskan dalam Strategi Pembangunan Pasca COVID-19 (PCDS) 2030.

Sarawak Pacu Pertumbuhan Tenaga Boleh Diperbaharui Untuk Manfaat ASEAN - Premier

SINGAPURA, 21 Okt (Bernama) -- Sarawak komited menyokong peralihan tenaga boleh diperbaharui di Asia Tenggara dengan memanfaatkan potensinya sebagai "Bateri ASEAN," yang akan membekalkan tenaga bersih menerusi sambungan Grid Kuasa Borneo dan ASEAN.

Belanjawan 2025 Percepat Peralihan Kepada Tenaga Bersih - Solarvest

KUALA LUMPUR, 19 Okt (Bernama) -- Belanjawan 2025 merupakan satu langkah ke arah mempercepat peralihan kepada tenaga bersih di Malaysia, kata Solarvest Holdings Bhd.

© 2025 BERNAMA. All Rights Reserved.

Disclaimer | Privacy Policy | Security Policy This material may not be published, broadcast,

rewritten or redistributed in any form except with the prior written permission of BERNAMA.

Contact us :

General [ +603-2693 9933, helpdesk@bernama.com ]

Product/Service Enquiries [ +603-2050 4466, digitalsales@bernama.com ]